does betterment send tax forms

Our suggestion is to be patient in filing. You also have to meet a minimum holding period.

It took 4 business day when I.

. You may be eligible to receive a 1099 form if your investment. Wait for funds to hit your. You should consult with a tax or legal professional to address your particular situation.

Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. There are three tax forms associated with health savings accounts HSAs. Funds will be wired back to the bank account you have listed in your account.

Postal Service to mail your tax return get proof that you mailed it and track its arrival at the IRS. IRS Form 1099-SA 5498-SA and IRS Form 8889. Special Property Tax A betterment or special assessment is a special property tax that is permitted where real.

Attach it to Vanguard signed forms and send it via mail to Betterment. Acorns does not provide tax or legal advice. Yes Betterment will send you the tax forms that you include in your tax filing.

Below is a schedule of various tax information forms that will be mailed to you or made available online by Merrill or K-1 partners in the first few months of the. State postal code in which the interest was earned should be entered for. So clearly rounding amounts from a.

Please use the information in your 1099-SA form available online. There are other similar forms that. There are various forms these institutions send out.

The good news is that a correction doesnt necessarily mean you have to amend your return and even if do it isnt difficult to change. You can get an extension for six months or so but one of the most. People do have a tendency to wait until the last minute noted Eric Bronnenkant head of tax at Betterment.

Form 1098 is the tax form that mortgage lenders use to report the deductible interest that you paid on your mortgage throughout the year. Ad Investing Technology Built for Low Fees to Seek Higher Returns Transparency. Tax Statement Mailing Dates.

The tax forms that Betterment will send you will be completely dependent on the type of accounts that you hold with them. The information below lets you know when you can expect to receive required tax. Betterment tax forms do not include a FATCA box as we do not allow for foreign investments in Betterment accounts.

Similarly to step 9Print one copy of your last Betterment statement. Calculated to determine the benefits received so long as it does not. Chase provides you with tax forms statements and important information to help you prepare for tax season.

These have their own unique tax treatments. We may also provide you with a Supplemental Tax Form that calculates key tax information for. In the unlikely event that there are corrections to your Form 1099 a revised document will be posted as soon as the correction has been filed generally in late February or.

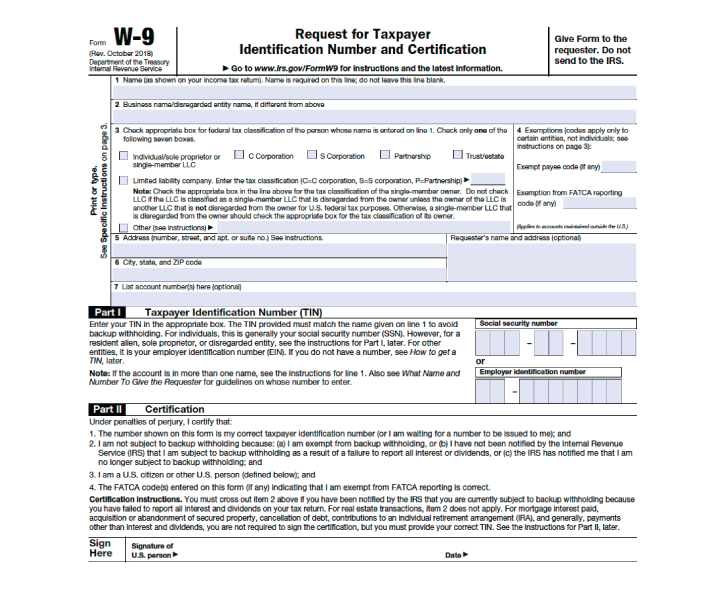

One copy is sent to the IRS and the account holder keeps the other. A few common investments that DO NOT qualify for this are REITs and MLPs. Any tax forms from Betterment that do not have a FATCA box can be.

Because these funds tend to take a little longer to report their annual results we wait to send your 1099 form with final numbers to avoid sending an amended tax form that may require you to re. Reasons You May Receive Tax Forms. Betterment Tax Forms.

Schedule B -- Form 1099-DIV Betterment Securities. Mail Your Tax Return with USPS. A Betterment account opened late January 2021 so first time filing taxes on it the desktop version of HR Block 2021 Deluxe Efile State.

Im getting this message from Turbotax. Betterment keeps track for you and provides all the tax documents you need.

Cease Desist Letter Templates 17 Free Word Excel Pdf Letter Templates Free Letter Templates Lettering

12 Free Contingency Plan Templates Ms Word Pdf Formats How To Plan Contingency Plan Business Contingency Plan

How Do You Read A Bank Balance Sheet A Bank S Balance Sheet Is Different From That Of A Typical Company You Won Balance Sheet Accounts Payable The Borrowers

Logicaldoc Launches Feature Allowing Preview Of Dicom Files Document Management System Press Release Distribution Health Care

Bank Lending Process Flow Chart Best Of Loan Process Flowchart 208791100766 Lending Process Flow Ch How To Plan Mortgage Process Business Plan Template Free

14 Free Progress Report Templates Ms Word Excel Pdf Formats Progress Report Template Progress Report Report Template

W 9 Form What Is It And How Do You Fill It Out Smartasset

How To Deduct Stock Losses From Your Taxes Bankrate

Skills For Acting Resume Luxury 5 Acting Resume Templates Besttemplatess123 Acting Resume Acting Resume Template Job Resume Examples

/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

Form 2439 Notice To Shareholder Of Undistributed Long Term Capital Gains Definition

Free 17 Real Estate Business Plan Templates In Google Docs Inside Real Estate Inv Business Plan Template Business Plan Template Free Real Estate Business Plan

Services Provided By A Title Company Title Insurance Title Property Tax

Weekly Planner Notepad Etsy Weekly Planner Notepad Planner Notepad Weekly Planner

Nonprofit Kit For Dummies By Stan Hutton Http Www Amazon Com Dp 047052975x Ref Cm Sw R Pi Dp Gsvysb0pyntspzs3 Start A Non Profit Non Profit Nonprofit Startup

Purchase Agreement Free Purchase Agreement Form Us Contract Template Separation Agreement Template Separation Agreement

After Event Report Template 5 Professional Templates Report Template Event Planning Checklist Templates Event Planning Template

:max_bytes(150000):strip_icc()/ScreenShot2021-02-10at4.22.05PM-66a7ee46923a4474b907ce6f25ca8bce.png)

Form 2439 Notice To Shareholder Of Undistributed Long Term Capital Gains Definition

/ScreenShot2021-02-06at4.24.16PM-695c2638669a4d1d81d1bfcd47a2d04b.png)

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at4.24.16PM-695c2638669a4d1d81d1bfcd47a2d04b.png)